New Energy Insights

- Home /

- New Energy Insights /

- What’s Holding Energy Storage Back in Minnesota?

This content was originally published by Clean Energy Economy MN, the business voice for energy efficiency and clean energy in Minnesota. View the original post, guest authored by our founder, Ralph Jacobson here.

Most people understand generally that solar energy becomes more valuable if some of it can be stored, to be available to be “dispatchable” when it is needed, and not just when the sun shines. It’s also pretty obvious that we can deploy more solar capacity if some of the energy can be stored, rather than waste solar production that can’t be used immediately. But precisely because storage is such a boon to solar, most of us tend to view energy storage as just an extension of solar technology, like solar on steroids. This is not very helpful for building a market for energy storage, because while solar needs to be optimized for maximum energy production, storage needs to be optimized for reliable capacity in specific functions (or “use-cases”) in the electric power grid. Effective storage policy should identify which use-cases will have the most value at different stages in our shift to cleaner energy sources.

Energy storage will pattern after the solar market in one significant way however: as the price of storage technologies comes down, the market will open up little by little. Uses for stored energy that are too expensive to finance today will become viable in the energy market as milestones of cost reduction and innovation are passed. Ironically, fossil fuels are stored energy, while direct use of solar energy is a new thing – storage brings it full circle, in a way. Our whole way of thinking about the electric power system is based on the luxury of drawing from huge reserves of fossil energy stored underground. Not only will energy storage make solar energy a better fit for the power grid but the timing of stored solar dispatch to the power grid can replace the dirtiest fossil-based power.

Our Starting Point in Minnesota

In 2013, the Minnesota Department of Commerce completed a cost-benefit analysis of four different use-cases for energy storage, commissioned by the 2012 legislature. At the annual CERTs conference that year, we sat through a presentation of the results and learned that only the case of utility-controlled storage had some near-term promise. I looked around the room at the assembly of solar industry advocates and leaders and felt a mood of dismay that the study had found so little market potential for any of the non-utility cases in the existing solar market. I will admit we were hoping some easy opportunities would be handed to us, and little did we know how important that information could be.

Learning from Other States’ Experience

At an energy storage conference in California the next year, I learned that the California Public Utilities Commission (PUC) had just set a target of an amazing 1.3 gigawatts of storage capacity by 2020, and that the state suddenly had the hottest market for storage in the US. Two of the best presentations were given, notably, by Southern California Edison (SCE) and San Diego Power and Gas. They each clearly described the issues they were having, and had practical ideas for developers.

Utility Acceptance of ES: the Vital Link from Good Policy to Good Programs

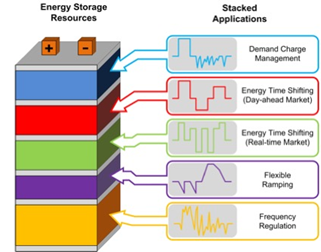

SCE was pioneering the “stack of values” approach to making stored energy more financeable at utility, community, and residential scales. I could see that in the CA regulatory environment, the utilities were taking a leadership role, working with the independent solar and storage industry to figure out solutions and make the storage market work. Understanding what has driven the creation of good programs, beyond merely good policy, will be helpful for figuring out an effective strategy to stimulate the market here in Minnesota. In each state where there is significant market activity, energy storage has shown up as a viable solution to major reliability challenges faced by utilities.

Avoiding Smog in Southern California

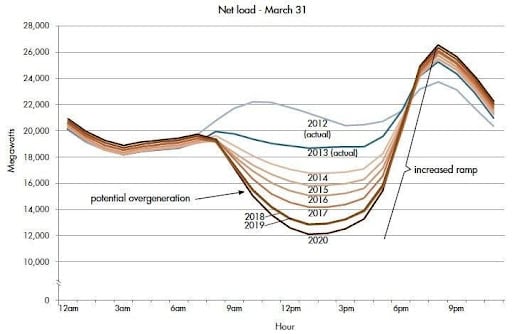

An average day of smog in LA might compare to the worst days of wildfire smoke last summer in Minneapolis. To keep the area more livable, the South Coast Air Quality Management District (SCAQMD) has some of the country’s most stringent air quality regulations. This aggressive regulatory environment has led to earlier utility acceptance of solar energy than in most other states. Solar energy now generates a significant percentage of California’s electricity, so that the daily peak load has been pushed further and further into the evening hours, when the sun is setting. The “Duck Curve” below illustrates this challenge. SCE either has to fire up peaking plants for a short duration – an inefficient, expensive, and polluting option – or to store enough daily solar production to cover that peak.

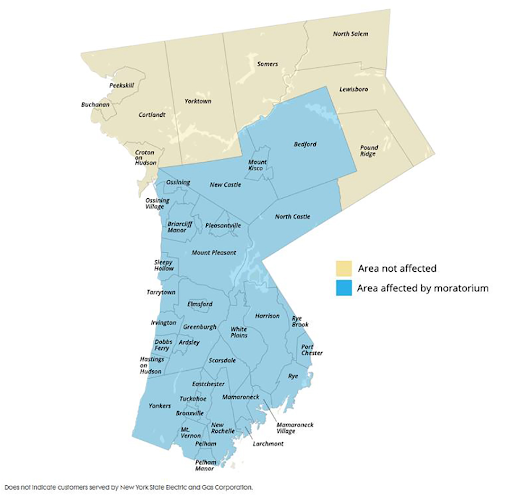

Moratorium In Near Upstate New York

A strong policy push over the past decade to move oil-based home and building heating to natural gas was so successful, that demand for natural gas exceeded supply capacity. This is a dangerous situation, and so the NY State Public Service Commission declared a moratorium on new applications for gas service and approved a suite of non-pipeline solutions. In addition, the Commission noted that the approved measures are the early stages of a long-term, comprehensive approach. This has created a strong movement towards electrification, such as heat pumps for space heating, which in turn is driving utility acceptance of solar plus storage for dispatchable electric capacity.

Replacement of Spinning Reserves in Indiana

An early use-case developed by Indianapolis Power and Light (IPL) several years ago was the replacement of some of their spinning reserves (see description below) by their 20 MW lithium battery facility. Electric utilities are required by state regulators to maintain extra generation capacity equal to a percentage of their average minimum daily load; this emits a significant level of CO2 just to keep generators spinning on idle. IPL reserved a portion of their battery capacity to sit full and ready to discharge if needed, then removed an equal number of MWHs from the daily workload of a coal-fired plant, and thereby took a large step toward reducing their GHG emissions. This is known as “spin” in the storage world, and it will have more value when supported by carbon pricing. Spin applies to both coal and gas-fired generation, and it could be an important element in the value stack for our utilities.

Which Market Drivers for Energy Storage in Minnesota?

Thankfully, Minnesota utilities do not yet have challenges of such magnitude, nor do we wish to wait until they do. But if we need strong drivers to accelerate utility acceptance of energy storage, what DO we have here to provide that push toward action?

- GHG reduction: Some higher expectations have been set at the global climate summit COP26, so our state must move toward more enforceable greenhouse gas reduction targets. When paired with storage, wind and solar can play a larger role in meeting aggressive targets and helping utilities decarbonize sooner.

- Accelerated coal phase-out: Although this issue is related to reduction of GHG emissions, economic pressure continues to build for utilities to phase out coal plants. Because energy storage is dispatchable, it can help offset some of the baseload power that utilities have long relied upon for coal to provide. The challenge is to ramp clean energy and storage up and ramp coal down in a way that minimizes worker dislocations and excess financial burdens. A report by the Rocky Mountain Institute discusses several mechanisms being developed to help utilities finance that process with minimum disruption.

- Reliability: Because utilities are held accountable for a high level of power reliability, energy storage can be used to support the distribution system for volt-var management and frequency regulation, as costs for storage come down.

Policy Foundation for Market Development

- Carbon pricing or carbon tax: For some use-cases, carbon pricing would enhance the value of energy storage for utilities and provide some capital, depending on how the money is used. A carbon tax is easier and quicker for governments to implement, and can be implemented in just a few months. Cap-and-trade requires more time to develop the necessary regulations, and is more susceptible to lobbying and loopholes; it also requires the establishment of an emissions trading market.

- Targeted tax credits: While it may be attractive to consider a general state tax credit for energy storage, tax credits which target specific use-cases will gain broader political support, because they are less open-ended. These could be enacted to incent utilities to apply energy storage to targeted high-priority loads: for example, the large industrial customer who has an interruptible power rate with a backup diesel generator, could see a utility program to offset some of that generator use with batteries.

- Wholesale market: the Midcontinent Independent System Operator (MISO) is preparing interim wholesale market rules for energy storage to roll out in 2022, under FERC Rules 2222 and 841. In Minnesota, where we have a highly-regulated utility structure, the best access to the wholesale grid services markets may be by incenting the utilities themselves to act as aggregators, allowing them to keep direct relationships with their customers who want storage.

- Least Cost vs. Best Value: When paired with solar, energy storage does not generate any new kilowatt-hours of energy beyond what is generated by the solar. Therefore, any policy analysis mechanisms based purely upon minimizing cost per unit generating capacity will make storage look like an additional cost with little benefit. A ”best value” approach will take into account the flexibility and versatility which storage can add to the power system.

- Good contracts vs. overly prescriptive legislation: At larger scales, good contract templates would allow all parties to create the stack of values needed to achieve a financeable level of cash flow. For aggregation of smaller behind the meter storage systems, where tariffs are offered as standard contracts, these could allow for utility control at key times only, which would help smaller customers pursue other revenue opportunities at other times.

Peak-Shaving Is Load Management: Just Add Batteries!

Many utilities have been implementing load management for decades, using tools such as yard lights, night-time heaters, interruptible power rates and conservation programs to engage their customer bases to help minimize the high and low extremes of the daily load profile. Everybody wins when the whole electric system operates more efficiently: rates remain lower and less fuel is required. However, the evening peak load continues to be a challenge, and as more solar generation is added to the system, this will get worse: Minnesota utilities will have their own “duck curves”. Energy storage provides two benefits: not only can solar energy be stored to avoid curtailment in the middle of the day, but that stored solar energy can be applied several hours later during the peak load. The good news is that existing load management programs have already put most of the customer relationship pieces in place for energy storage to enter the market, as prices decline.

Milestones for Market Growth

Let’s imagine a timetable for use-cases to become financeable, beginning with what we learned from the 2013 Department of Commerce study. That is, for any storage use-case to achieve a high value for a utility, it must be utility-controlled, or at least allow for shared-control at key times. In several states this is already a reality, where control shifts back and forth between a non-utility owner of energy storage and their utility provider. A near-term timeline for Minnesota could include replacement of spinning reserves at key times and peak-shaving. The electric power market in Minnesota is ready for bigger policy steps to create value for energy storage, addressing challenges faced by utilities as well as communities. And if we want to see the whole process move more quickly, we must consider storage on its own terms, and not just as an extension of wind and solar.

Stay up-to-date with New Energy Equity by joining our mailing list.