New Energy Insights

- Home /

- New Energy Insights /

- Decarbonization: Helping The Oil and Gas Industry Reach Their Bottom Line

Evan is New Energy Equity’s newest engineering intern. He brings a unique perspective as he has spent the last six years working as a chemical engineer for an oil and gas licensor, who sold technologies to companies like Shell, Exxon, Marathon, Pemex, and Sasol. The oil and gas industry needs a complete overhaul to reach the momentous goals of the Paris Agreement and truly address climate change. Using his previous experience, as well as additional investigation, Evan reveals exactly how the oil and gas industry could decarbonize while keeping its operations and profits intact.

Why Oil and Gas Should Shift to Greener Energy

A report by the International Energy Agency (IEA) revealed that to achieve 100% clean energy, oil and gas companies also need to commit to the cause.1 Without the oil and gas industry on the side of the clean energy transition, we will not be able to achieve 100% clean energy, as industry operations makes up 4.1 GtCO2e greenhouse gas emissions or 10% of all human-made greenhouse gases.2 While making the world a greener, cleaner, and overall more sustainable place to live is an obvious incentive, there are economic incentives that switching to cleaner energy would yield for the oil and gas industry.

Stabilizing A Cyclical Market

The markets of oil and gas can be very cyclical depending on the price of crude or international politics. There are efforts to stabilize the cyclic nature through investing in technical service subscriptions using Internet of Things remote monitoring, but there are still unfavorable market trends that cannot be avoided. In contrast, the power source of renewable energy is, for the most part, predictable and steady. Yes, the wind may only blow at certain times of the day and the sun is not always out, but no one expects wars to be fought over access to the sun like there are with oil.

A Shift in The Market

Market trends are already shifting away from producing motor oils and fuels towards petrochemicals. Instead of using hydrocarbons to make gasoline and diesel, they are being used to make products like lubricants, paints, and plastics. Oil and gas companies are continuing to increase their production rates and capacities, but the demand is not meeting the expanded supply. 3 The shift in these demands is a result of an emphasis on vehicle fuel efficiency.4 Since vehicles are using less fuel, there is decreased demand for gasoline.

Government Incentives In Renewables

For oil and gas operators, there are continued government incentives in renewables, similar to the subsidies that refining already receives. Gas companies have benefited from low taxes on automotive gasoline compared to other countries. There are comparable incentives in the renewable space with the federal solar investment tax credit and several local incentives.

A Comparable Rate of Return

The renewables industry is easier to break into than oil and gas, and, more importantly, companies are seeing comparable returns on their renewable investments. Many companies will need a financial incentive to start addressing climate change, and there are already several incentives for oil and gas to invest heavily in green energy. If the incumbent energy leaders fail to make investments in renewables they will be left behind just like those in the automotive, media, and telecommunication industries.5

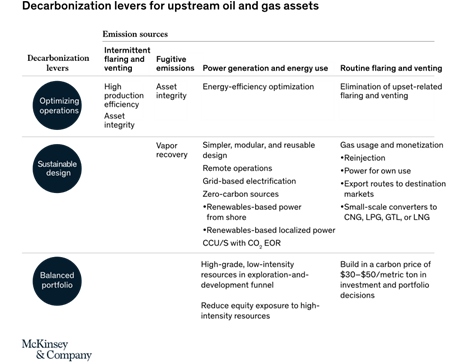

Decarbonizing levers for upstream oil and gas assets.2

How Oil and Gas Can Start to Decarbonize

So what steps can the oil and gas industry take to begin investing in clean energy and reduce their emissions?

Optimize Operations To Avoid Flaring: The most cost-effective method to cut back on emissions is optimizing operations through reduced flaring, better equipment efficiency, and better monitoring of leaks. By reducing unexpected and emergency shutdowns, which leads to the flaring of methane and carbon dioxide, companies can save on unnecessary emissions. When a refinery has an unexpected issue, usually the first step is to flare gas in order to relieve pressure or flow. This is done as a safety measure to protect personnel and equipment but obviously has environmental consequences. Other alternatives to flaring are utilizing the flared natural gas for power generation, rerouting its storage to be sold, or converting it to usable LPG.

Verify Equipment is Running Near Design: Over time, equipment does degrade, which is unavoidable. However, some equipment, like pumps, have an efficient operating curve that can be optimized. Similarly, reactors can be optimized by running at the best temperature and pressure to produce the selective production of fuels or petrochemicals. By consistently checking for fugitive emissions or leaks, companies will be able to routinely identify and correct any troublesome locations like flanges, (the connection between pipes), or seals, (an internal piece of pumps). Some companies, like Acoustic Wells, are using the Internet of Things and artificial intelligence to monitor for emission leaks.

Closing Carbon Intensive Wells: Finally, if upstream oil and gas companies, such as those focused on drilling and extraction of oil, close their most carbon-intensive wells, they would reduce emissions and improve the profitability of their portfolio.

These options not only reduce greenhouse gas emissions but also make financial sense for oil and gas companies. There is no reason not to invest in cleaning up their portfolio of assets. 5

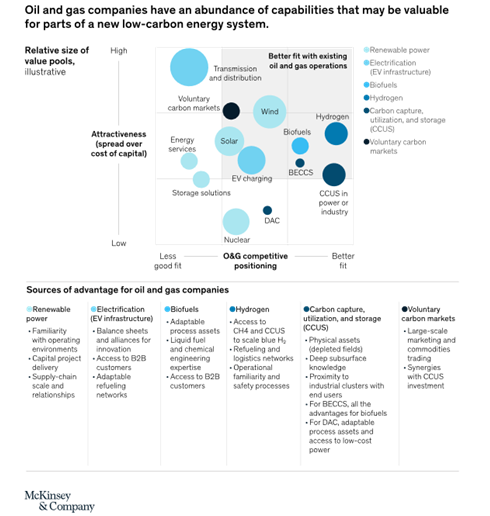

Valuable capabilities for a new low-carbon energy system. 2

What Technologies Should Oil and Gas Develop?

Hydrogen: Oil and gas companies are investing in natural gas as their move to become greener, but burning natural gas still releases greenhouse gases. A better alternative is hydrogen. Oil and gas infrastructure is based on generating, moving, and storing hydrocarbons. The same infrastructure can be used for hydrogen. 75% of global production of hydrogen currently uses natural gas as the feedstock2. It is produced from a process called steam-methane reformation, where hydrocarbons are broken down and have hydrogen as an off-product.6 However, hydrogen can be produced with electrolysis, which separates water into hydrogen and oxygen with no emissions and would be the best option if switching to hydrogen as a source of energy.

Increase Carbon Capture, Utilization, and Storage: In order to achieve the Paris Agreement target, the amount of carbon capture, utilization, and storage (CCUS) will need to multiply by at least 50.5 Carbon capture refers to the process of removing carbon dioxide from the air by absorbing it into solvents or chemicals. The carbon dioxide can then be separated from the solvent, which is reused to capture more carbon dioxide, which can then be utilized in production, similar to soda carbonation. The alternative to using carbon is to store it underground with sequestration, but this creates the potential risk for it to leech out. It is debated that CCUS will prolong the use of fossil fuels since it prevents greenhouse gas emissions, but this is a solution that must be implemented in tandem with reducing fossil fuel usage.

Electrify Chemical Manufacturing: Chemical manufacturing, including the production of oil and gas, can be electrified on an industrial scale. Using electricity to heat manufacturing processes has the potential to be a viable option by 2025. Electrochemical processes can be used to produce commodities and specialty chemicals rather than using fossil fuels as a source for raw materials and heating.7

Conventional oil and gas companies have a long road to decarbonization, yet there are technologies like hydrogen, CCUS, and electrification that presently exist to help in that journey. Companies such as BP are shifting their strategies towards a holistic energy portfolio to capitalize on their capabilities, technologies, and relationships. This means investing in renewables, biofuels, and hydrogen. If this is not the desired direction for a company, other options include capturing carbon and electrifying their processes.

Decarbonization is Possible!

The oil and gas industry has an economic incentive to decarbonize. Markets are trending towards clean technology, and it is in their best interest to invest if they want to remain relevant in energy. Operation optimization is a great first step towards decarbonization and ultimately improves their efficiency and bottom line. If oil and gas companies want to make a dedicated commitment to becoming greener, technologies like hydrogen electrolysis; carbon capture, utilization, and storage; and industry wide electrification are all currently available and could benefit from the resources of conventional energy companies to develop them further. The time is now. Why wait?

How Can New Energy Equity Help You Reach Your Solar Goals?

References:

- https://www.iea.org/reports/the-oil-and-gas-industry-in-energy-transitions

- https://www.mckinsey.com/industries/oil-and-gas/our-insights/toward-a-net-zero-future-decarbonizing-upstream-oil-and-gas-operations

- https://www.onealinc.com/oil-demand-growth-to-shift-to-petrochemicals/

- https://www.transportenergystrategies.com/2018/12/06/one-chart-impact-on-oil-demand-from-fuel-economy-biofuels-natural-gas-evs/

- https://www.mckinsey.com/industries/oil-and-gas/our-insights/the-big-choices-for-oil-and-gas-in-navigating-the-energy-transition

- https://www.energy.gov/eere/fuelcells/hydrogen-production-natural-gas-reforming

- https://www.aiche-cep.com/cepmagazine/march_2021/MobilePagedArticle.action?articleId=1663852&app=false&cmsId=3892470#articleId1663852

Stay up-to-date with New Energy Equity by joining our mailing list.

.png)